Daily Market Analysis

Market Focus

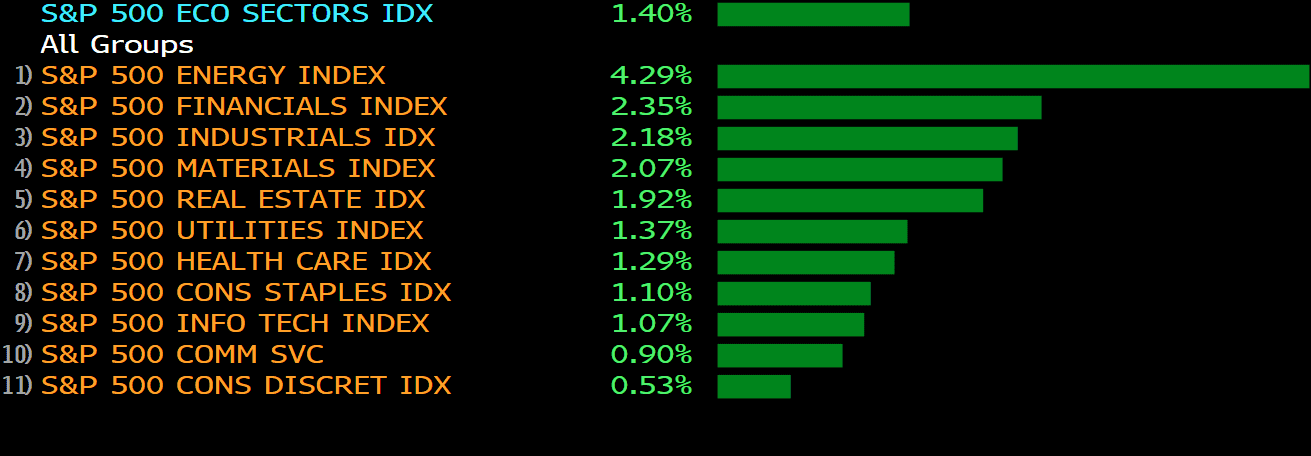

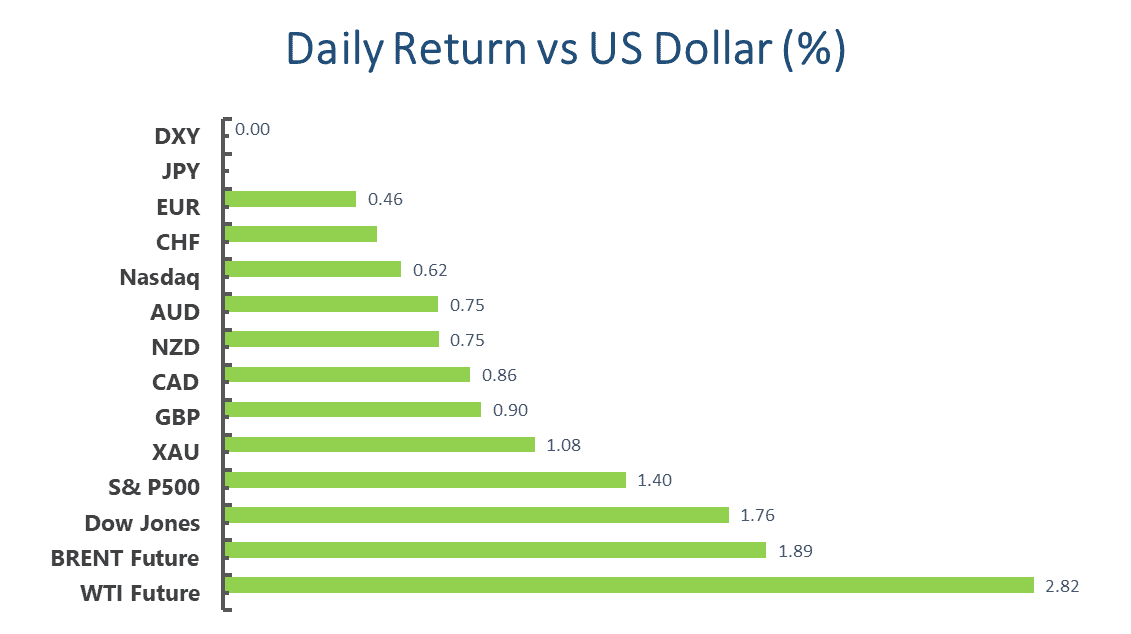

Dow Jones futures, along with S&P 500 futures and Nasdaq 100 futures, were higher late Monday following the Dow Jones-led stock market rally. On Monday, the tech-heavy Nasdaq gained 0.84% (118.5 points), while the S&P 500 rallied 1.4% (59.2 points). The Dow Jones Industrial Average surged 1.8%, or 586 points. Among the Dow Jones leaders, Apple (AAPL) advanced 1.4% Monday, while Microsoft (MSFT) moved up 1.2% in today’s stock market; Tesla (TSLA) fell 0.4% Monday, as it battles to retake its long-term 200-day moving average.

Federal Reserve Chair Jerome Powell said inflation had picked up but should move back toward the U.S. central bank’s 2% target once supply imbalances resolve. “Inflation has increased notably in recent months,” Powell said in written remarks prepared for his Tuesday testimony before the House Select Subcommittee on the Coronavirus Crisis, citing increases in oil prices and a “rebound” in spending as the U.S. economy reopens. “As these transitory supply effects abate, inflation is expected to drop back toward our longer-run goal.” he said.

However, some Fed officials estimate that the central bank may need to tighten policy sooner than it expects. Dallas Fed President Robert Kaplan said he favors starting the process of tapering the central bank’s ongoing bond purchases “sooner rather than later,” while his counterpart from St. Louis, James Bullard, called it “appropriate” that policy makers last week opened the taper debate. Neither Bullard nor Kaplan votes on the Federal Open Market Committee this year.

Powell’s remarks reprised his opening comments at his June 16 press conference, following a policy meeting of the central bank. Investors will tune in to the hearing Tuesday for potential questions that shed more light on his view on the pace of the economic rebound and for how much longer the central bank should keep its monetary policy on an emergency footing.

Main Pairs Movement:

Dollar underwent a correction due to its extreme overbought conditions, but it remains the strongest currency across the Forex board. It lost most of its gains in the previous day during the North America session amid solid equity rallies.

Euro pair corrected up to 1.1920, holding nearby at the end of the day. ECB’s President Christine Lagarde said that the outlook for the euro area economy is brightening as the pandemic situation improves but warned about the need to remain vigilant, suggesting that tightening would be premature.

Cable surged on the optimistic market mood despite worrisome comments from the UK Prime Minister Boris Johnson. Johnson said that cases of the coronavirus Delta variant are still going up, and thus they need to be cautious on easing restrictions. He then added that data is looking good ahead of the July 19 deadline, but traveling will still be “difficult.”

Aussie trades around 0.7540, helped by the better performance of equities. Loonie pair plummeted over 100 pips on a daily basis, benefitting from the greenback’s corrective decline and soaring crude oil prices. WTI closed the day at $73.00 a barrel, while Brent climbed 2.20% during the day. Gold posted a modest daily advance. Spot gold settled at $ 1,784 a troy ounce.

Technical Analysis:

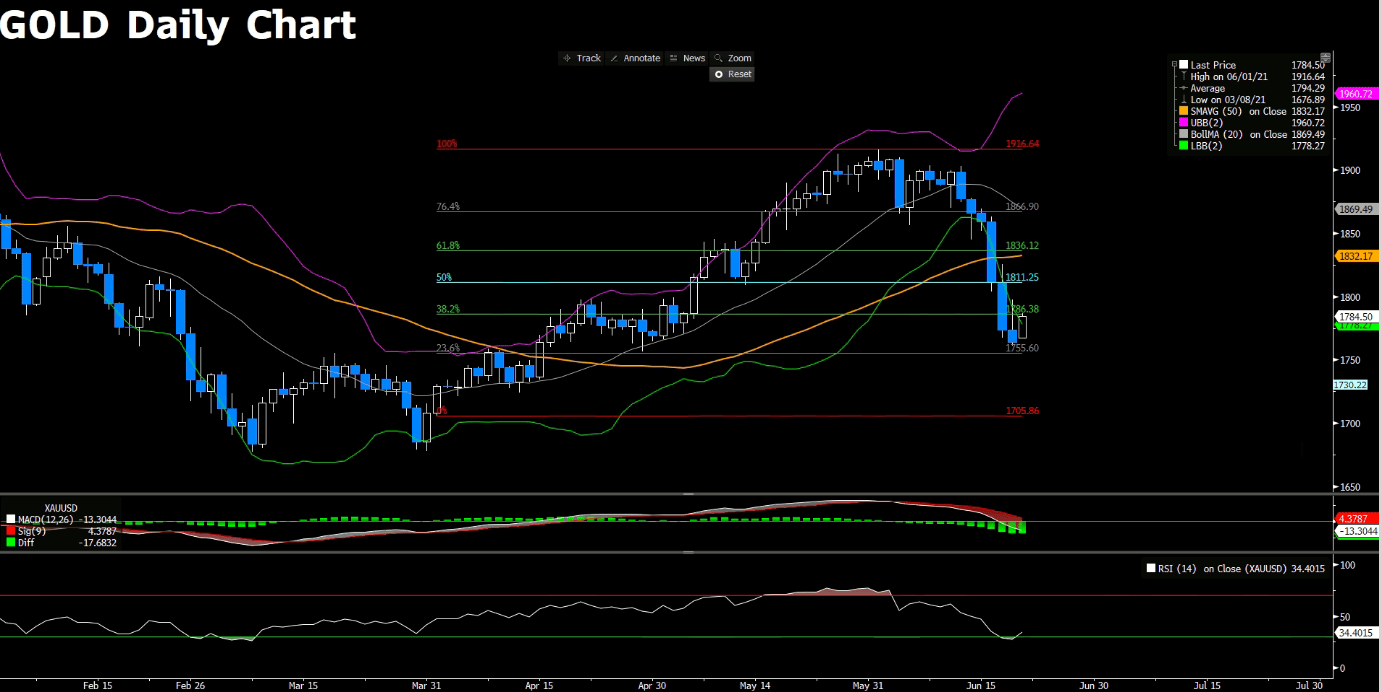

XAUUSD (Daily Chart)

Gold looks to pick up the recovery after dropping to the monthly low. In the near- term, it is expected to see some bulls on gold as it needs an adjustment from its oversold condition. From the technical indicators, both RSI and bollinger band show that gold needs a rest from its bearish momentum. The RSI is currently near 30 level, indicating that gold is due to a bounce back; at the same time, gold has reached the very lower band of bollinger band, which also suggests a bounce back from gold. At the moment, gold is clinging at the resistance level, 1780ish; to the upside, if gold can successfully breach the resistance, it will head toward 1811.25.

Resistance: 1786.38, 1811.25, 1836.12

Support: 1755.6, 1705.86

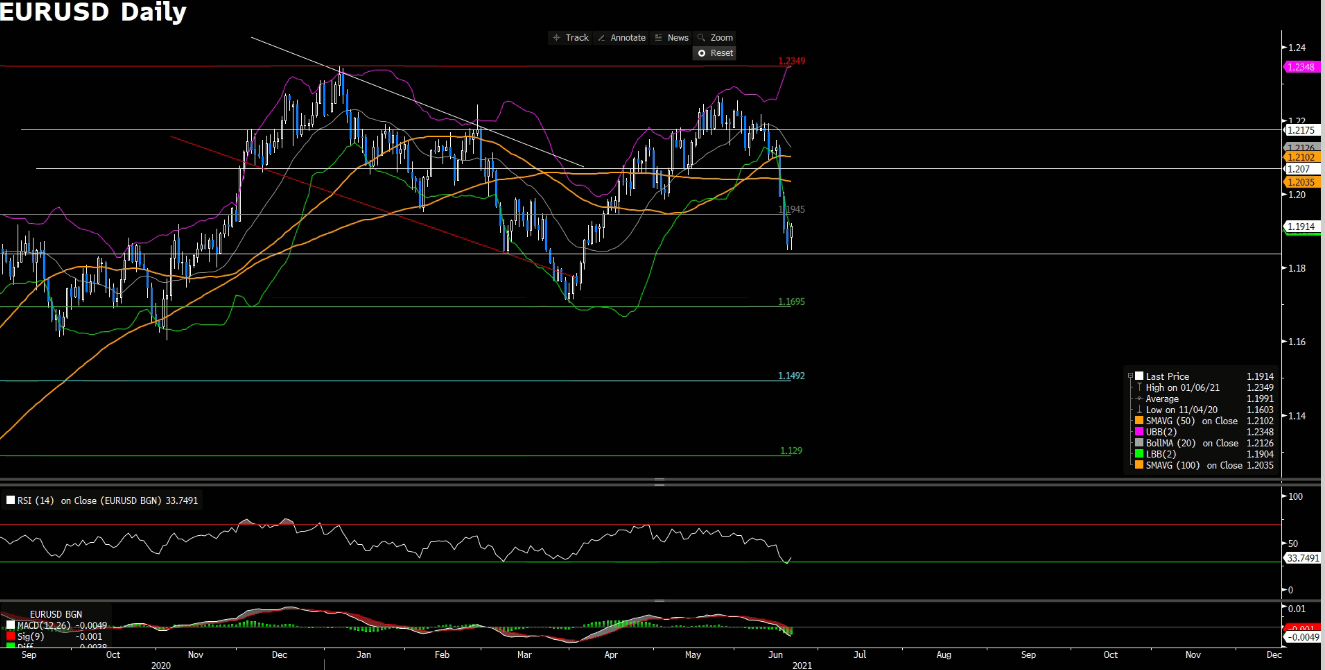

EURUSD (Daily Chart)

EURUSD recovers back to 1.1910 level to start the week as the time of writing, correcting extreme oversold conditions from last week. The pair remains bearish as it declined all the way below the descending channel to a new low last week; despite of showing a bounce back on Monday, the outlook remains bearish. After plunging sharply to April’s support level at 1.18760, the pair bounces back a little to its immediate resistance level at 1.1945. At the moment, the RSI is located at 30ish level, which is close to the oversold territory, giving the pair rooms to bounce back for an adjustment. Moreover, the MACD seems to turn positive on the four hour chart, lending supports to bulls. As the time of writing, EURUSD is trading along the resistance level at 1.1945; if it can successfully breaches the level, it will potentially head to the next resistance at 1.2070; otherwise, the pair might consolidate in the range of 1.1945 and 1.18760 in the near- term.

Resistance: 1.1945, 1.207, 1.2175

Support: 1.18760, 1.1695

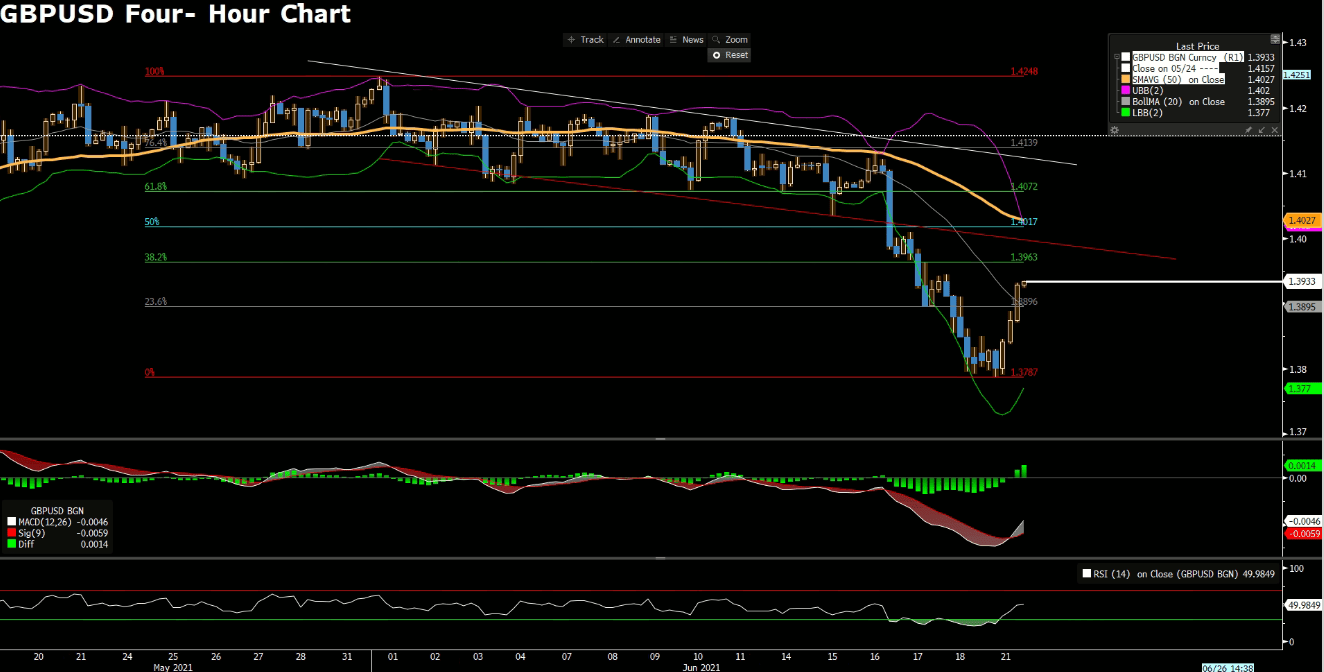

GBPUSD (Four-Hour Chart)

GBPUSD advances beyond 1.3900 today, extending the corrective pullback. From the technical perspective, the intraday retreat from 1.3800 level could be attributed to a correction from the previous oversold condition. On the four- hour chart, GBPUSD remains bearish as it continues to fall below the descending channel; however, the short- term momentum seems to turn bullish as the technical indicator, RSI, is currently in the neutral position, giving the pair rooms to extend further north; in the meantime, the MACD has turned to positive, lending supports to bulls. To the upside, GBPUSD is expected to head toward the next immediate resistance at 1.3963, and 1.3896 will become the immediate support for the pair.

Resistance: 1.3896, 1.3963, 1.4017

Support: 1.3787

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

BRL |

BCB Copom Meeting Minutes |

19:00 |

N/A |

||||

|

USD |

Existing Home Sales |

22:00 |

5.72M |

||||